A look at how Scott County's property tax rate stacks up

Plus: Landfill fight next moves to Town of Winfield, Scott County Scouts head to summer camp, and a look at middle school baseball all-district selections.

Good Monday morning! Welcome to a brand new week. This is The Daybreaker, the first of several newsletters that will be published this week by the Independent Herald. The Daybreaker (Monday) and The Weekender (Thursday evening) are our two news-first newsletters. We publish several other newsletters throughout the week, as well as our regular E-Edition on Thursday and our Varsity E-Edition on Sunday (during sports season). If you’d like to adjust your subscription to include (or exclude) this or any of our other newsletters, please do so here. If you need to subscribe, it’s as simple as entering your email address:

Since 1904, First National Bank has been a part of Scott County. First National is local people — just like you. Visit fnboneida.com or call (423) 569-8586. (Sponsored content.)

How does Scott County’s property tax rate stack up historically and with the rest of the state?

Scott County Commission will consider the budget for fiscal year 2025-2026 in two meetings later this month: the regular meeting next week, and a called meeting the week after that. As proposed by the Commission’s Budget Committee, the budget includes no tax rate increase and a 5.5% pay increase for all county employees.

That means, if approved as presented, Scott County’s property tax rate will remain $1.60 per $100 assessed value for fiscal year 2025-2026, which begins July 1. For residents and businesses inside the Oneida Special School District, the tax rate is $2.11 per $100. That special tax rate was adopted on referendum by voters of the school district in the early 1990s as a way to help fund the school system.

How to determine your taxes

In Tennessee, residential property is assessed at 25% of its appraised value — meaning property owners pay taxes on 25% of the property’s worth. To calculate your tax bill, divide your appraised value by four, and multiply it by the tax rate.

For example, the average home value in Scott County is about $175,000, according to Zillow. If your home appraises at $175,000, you’re taxed on $43,750, which is one-fourth of $175,000. The property tax would be $700, or $923.13 if you live inside the Oneida Special School District.

This is the formula for calculating the property tax: $175,000/4 = $43,750/100 = 437.5x$1.60 = $700.

Who determines the tax rate

Under Tennessee’s county system of government, responsibilities are clearly defined for public officials:

First, the Scott County Assessor of Property’s office determines the county tax appraisal for each parcel of property, using state guidelines and a computer-aided process. Scott County’s elected Assessor of Property is Tiffany Jeffers.

Next, Scott County Commission sets the tax rate. County Commission is a 14-member legislative body with two representatives elected from each of the county’s seven civil districts. Approval of the tax rate requires a simple majority vote (eight members).

Finally, the Scott County Trustee’s office mails tax bills and collects the taxes. Scott County’s elected Trustee is Rena Erwin.

Municipal taxes must be considered

Residents of the towns of Oneida and Huntsville pay additional property taxes to their respective municipal governments. In Oneida, the tax rate is $1.50 per $100. In Huntsville, the tax rate is $0.50 per $100.

Therefore, the total tax rate inside the Town of Oneida — including what property owners pay to the county and what they pay to the city — is $3.61 per $100, which also includes the 51-cent Oneida Special School District tax. The total tax rate inside the Town of Huntsville is $2.10 per $100.

Tax rate through the years

Scott County’s property tax rate through the years looks like this, with asterisks denoting reappraisal years. Reappraisal years are state-mandated updates of each property’s worth, based on current trends. The current tax rate remains at its lowest point of the past 30 years — which is due in large part to property values remaining at record highs.

2025: $1.60 (proposed)

2024: $1.60

2023*: $1.60

2022: $2.46

2021: $2.46

2020: $2.46

2019: $2.46

2018*: $2.46

2017: $2.46

2016: $2.37

2015: $2.37

2014: $2.25

2013*: $2.25

2012: $2.22

2011: $2.22

2010: $2.22

2009: $1.97

2008*: $1.97

2007: $2.67

2006: $2.67

2005: $2.40

2004: $2.40

2003*: $2.33

2002: $2.40

2001: $3.40

2000: $3.40

1999: $3.40

1998*: $3.57

1997: $3.29

How it stacks up statewide

Scott County’s property tax rate ranked 28th in the state in 2024, meaning there were 27 counties with lower tax rates and 67 counties with higher tax rates. Here are the counties with the lowest tax rates, in order:

1.) Gibson — $0.83

2.) McMinn — $1.08

3.) Cumberland — $1.13

4.) Campbell — $1.21

5.) Fayette — $1.21

6.) Rhea — $1.34

7.) Fentress — $1.35

8.) Weakley — $1.37

9.) Obion — $1.38

10.) Loudon — $1.38

11.) Carroll — $1.41

12.) Sumner — $1.42

13.) Grundy — $1.42

14.) Jefferson — $1.43

15.) Bradley — $1.43

16.) Henderson — $1.45

17.) Sevier — $1.48

18.) Stewart — $1.48

19.) Tipton — $1.52

20.) Monroe — $1.52

21.) Knox — $1.55

22.) Moore — $1.56

23.) McNairy — $1.57

24.) Blount — $1.59

25.) Cheatham — $1.59

26.) Marion — $1.59

27.) Cannon — $1.59

28.) Scott — $1.60

29.) Macon — $1.62

30.) Greene — $1.65

The property tac rate is $1.71 in Pickett County, $2.62 in Anderson County, and $2.71 in Morgan County. The state’s highest county property tax rate is found in Shelby County at $3.39. The average property tax rate is $1.87.

Overall, there are 424 unincorporated county rates, city rates within counties, or special school district rates within counties found throughout Tennessee. Out of 424, the total tax rate for residents of the Town of Huntsville ranks No. 124 and the total tax rate for residents of the Town of Oneida ranks No. 272.

Editor’s Note: Information contained within this story is permanently available from the Encyclopedia of Scott County.

Landfill fight moves to Town of Winfield next

Opinions have been voiced against a proposed landfill at Bear Creek in front of Scott County Commission and the Town of Oneida’s Board of Mayor and Aldermen. Next could be the Town of Winfield’s Board of Mayor and Aldermen, which meets Tuesday afternoon in regular session.

While none of the three local government entities are backing the proposed landfill, and none are responsible for permitting the landfill, local residents have made their opinions loud and clear — first at a meeting of County Commission last month, then at a public forum hosted by the Town of Oneida on Thursday.

The proposed site of a rail transfer station to serve the landfill is located on the southern edge of the Winfield city limits, along Poplar Lane. However, it does not appear that Winfield has zoning regulations in place that would prevent the transfer station.

Trans-Rail Waste Services has applied with the TN Dept. of Environment & Conservation for a permit to build a transfer station along the Norfolk-Southern Railroad at Poplar Lane, on a parcel of property owned by Bearcat Properties Inc. That company owns most of the 700 acres of land being considered for the new landfill.

According to developer Knox Horner, who has become the public face of the landfill proposal, trash would be shipped to Scott County in sealed containers, offloaded onto trucks at the transfer station for the final distance into the nearby landfill, where the containers would be opened and emptied.

State regulations require transfer stations to be located a minimum of 500 feet from the nearest residence. There is a residence on Poplar Lane approximately 300 feet from the entrance to the property where the transfer station is planned; however, that parcel of property extends several thousand feet further north along the railroad. The location is three-tenths of a mile — 1,500 feet, or five football fields laid end to end — from Winfield Elementary School. For the sake of comparison, McCreary County Middle School is about the same distance — 0.33 mile — from a transfer station operated by McCreary County on Cabin Creek Road in Stearns.

Winfield’s board meetings begin at 1 p.m. on the second Tuesday of each month.

Correction: An earlier version of this story incorrectly stated that transfer stations must be located a minimum of 1,500 feet from the nearest residence. The correct distance is 500 feet.

Need a good rate on your auto insurance? Contact your local State Farm agent, Roger Baldwin. (Sponsored content.)

Scouts spend a week at camp

Boy Scout Troop 333 and Crew 333 from Scott County spent last week at summer camp at Camp Buck Toms in Rockwood, Tenn. Some of the classes scouts took were horsemanship, C.O.P.E. (Challenging Outdoor Personal Experience), mountain biking, kayaking, stand-up paddle boarding, lifesaving, metalworking, rifle, small boat sailing, motor boating, canoeing and archery.

Scouts meet at 6 p.m. each Tuesday at the American Legion’s War Memorial Building on Alberta Street in Oneida.

Baseball and softball all-district honors

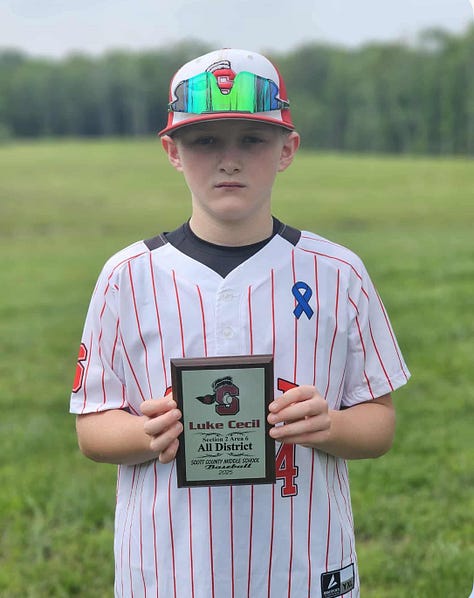

The Scott County middle school baseball team’s Luke Cecil (Burchfield, sixth grade) and Jacob Byrd (Robbins, seventh grade) were awarded all-district honors at the conclusion of the 2025 season. Additionally the Scott County middle school softball team’s Bristol Partin (Winfield) and Maci Harness (Huntsville) were awarded all-district.

These photos were submitted.

Two from Scott named to Dean’s List at Lincoln Memorial

HARROGATE, Tenn. | Two students from Scott County have been named to the Dean’s List at Lincoln Memorial University for the spring semester of 2025. To be placed on the Dean’s List, students must be full-time undergraduates and have a 3.5 or higher GPA for the semester.

The local students included:

Kalin Jeffers, Oneida (Bachelor of Science in Nursing)

Taylor Chambers, Helenwood (Bachelor of Science in Veterinary Medical Technology)

Today’s newsletter is sponsored by the Scott County Chamber of Commerce. Since 1954, the Scott County Chamber of Commerce has advocated for a strong community by supporting stronger infrastructure and leadership.

The Week Ahead

⛈️ Weather: Rain will become likely this evening. Otherwise, we’ll see partly sunny skies today and a high of about 82°. Rain will remain likely tonight, but will taper off quickly. The next few days look really nice! Check out our daily Eye to the Sky updates on our Facebook page — published each morning at 7 a.m. on the dot.

—

📅 Community Calendar

Monday: Ridgeview Behavioral Health Services’ Mobile Health Clinic will be in the Walmart parking lot in Oneida from 9 a.m. to 3 p.m., offering integrated primary care and behavioral health. No insurance is not a problem. Call (866)599-0466 for more information.

Monday: Huntsville Pool will be open from 11 a.m. to 5 p.m. today and every day this week ($3). The Oneida Splash Pad is also open.

Monday: The Scott County Senior Citizens Center (Main Street, Oneida) will serve lunch from 11:30 a.m. until 1 p.m. The cost is $7 for dine-in or carry-out. Phone: (423) 569-5972.

Monday: The Scott County Finance Committee will meet at the Scott County Mayor’s Office in Huntsville, beginning at 5 p.m.

Monday: Vacation Bible School will be held at Pine Grove Baptist Church Monday, June 9, through Friday, June 13, from 6 p.m. to 8:30 p.m. each evening. There will be lessons, food, crafts, singing and more.

Tuesday: The Scott County Senior Citizens Center (Main Street, Oneida) will host exercise from 10 a.m. until 11 a.m.

Tuesday: Pinnacle Resource Center’s food pantry (1513 Jeffers Road, Huntsville) will be open beginning at 10 a.m. There are no income guidelines; however, a photo ID and a piece of mail with a Scott County address are required.

Tuesday: The Winfield Board of Mayor and Aldermen will meet at 1 p.m. at the Winfield Municipal Building.

Tuesday: The Oneida City Park Farmers & Makers Market will be from 5 p.m. until 7:30 p.m. Call (423) 569-8300 for more information about becoming a vendor.

Tuesday: Boy Scout Troop #333 will meet at the Oneida War Memorial Building on Alberta Street in Oneida beginning at 6 p.m.

Tuesday: Wall Builders will meet from 7 p.m. until 9 p.m. at Trinity Baptist Church (1611 Glass House Road, Helenwood) for those struggling with addiction or striving to keep off drugs. There will be preaching, teaching, food, fellowship and personal counseling.

Wednesday: The Scott County Senior Citizens Center (Main Street, Oneida) will serve lunch from 11:30 a.m. until 1 p.m. The cost is $7 for dine-in or carry-out.

Thursday: The Gerry McDonald Mission House, located on Church Avenue, directly behind First United Methodist Church, is open from 9 a.m. until 12 p.m. You are eligible to receive food once per month. For more information or requirements, call the church office at 569-8828.

Thursday: The Scott County Senior Citizens Center (Main Street, Oneida) will host exercise from 10 a.m. until 11 a.m.

Thursday: The Scott County Board of Education will meet at the Central Office in Huntsville, beginning at 4:30 p.m.

The Community Calendar is presented by Citizens Gas Utility District. Citizens Gas operates natural gas distribution pipelines in portions of Scott and Morgan counties. Visit citizensgastn.com.

Thank you for reading. Our next newsletter will be Echoes in Time tomorrow. If you’d like to update your subscription to add or subtract any of our newsletters, do so here. If you haven’t yet subscribed, it’s as simple as adding your email address!

◼️ Monday morning: The Daybreaker (news & the week ahead)

◼️ Tuesday: Echoes in Time (stories of our history)

◼️ Wednesday: Threads of Life (obituaries)

◼️ Thursday evening: The Weekender (news & the weekend)

◼️ Friday: Friday Features (beyond the news)

◼️ Sunday: Varsity (a weekly sports recap)